Stockholders Conference Call

email your question

You may email your questions in advance to ir@punchtvstudios.com

call in to speak to the host

Call in to speak with the host (516) 666-9817

Punch TV Studios has decided to streamline the company making a bold move to build back stronger. Coming through covid has been a challenge for our company, as one can only imagine. But we are still here!

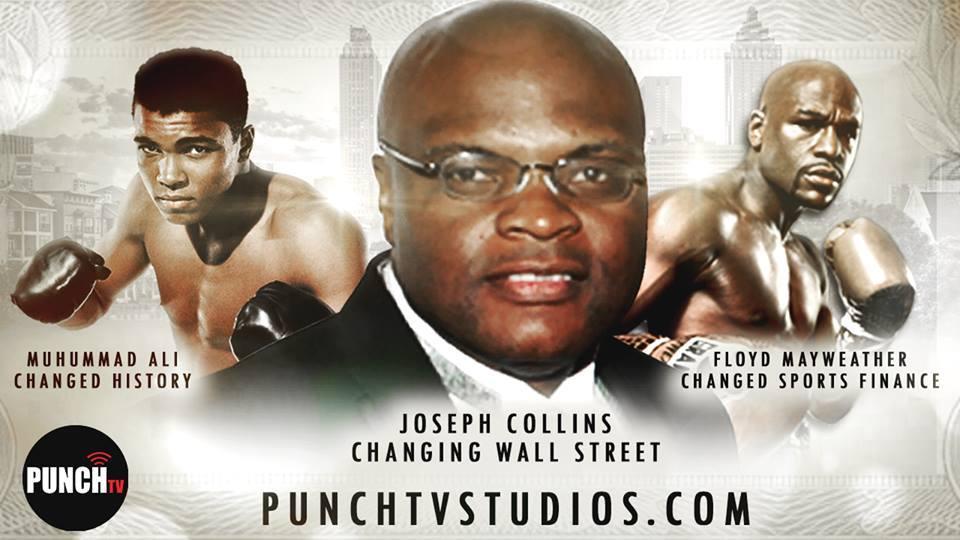

Punch TV Studios is a media production and distribution company founded by Chairman and CEO Joseph Collins. We are committed to delivering fresh, and cutting-edge entertainment for a global audience.

Despite the difficulties of the past two years, Punch TV Studios is proud to announce that we are emerging stronger than ever. Our company was founded on the principle of creativity and resilience and that has been evident in the way we have navigated these tough times.

The iconic Hollywood production company has opened its doors and is already hard at work on a slate of new content. CEO Joseph Collins says, “Punch TV Studios is best known for producing hit shows like Martial Arts TV and The Hollywood Punch Report, the studio’s progressive streamlining comes at a time when the entertainment industry is undergoing a major upheaval, with traditional media companies struggling to adapt to the digital age.”

Punch TV’s innovative approach to production well positions us to lead the charge into the future of entertainment.

Our company is looking forward to producing new and innovative content. The core team has come together to support each other in both professional and personal ways.

We express gratefulness for the loyalty of our stockholders and supporters, who have stood by us during this challenging period.

Our excitement continues as we look to bring the best in entertainment while also expanding our reach to new audiences. We are beginning to reach out around the world for innovative films and television productions that we can distribute

Thank you for being part of our journey – we can’t wait to see what the next chapter holds

The connotation of the word, “Recidivist” is well-known. Even the vastly under-educated are aware that both denotatively and connotatively, the term references an individual who repeatedly engages in criminal behavior. Yet, the Securities and Exchange Commission circulated a press release that attached such a description to my name – the name of a person who has never engaged in criminal behavior in his life, nor committed a crime, nor been arrested, convicted, nor imprisoned for a crime. Well, perhaps I should re-state this… I think I may have received a ticket for a traffic violation at one point in my life..

However, my accuser, was the United States Securities and Exchange Commission (SEC) – an organization that was established in 1934 for the express purpose of overseeing capital markets so that the devastated United States of the Great Depression could never, ever again reoccur.

In some sense, we can say that the SEC has achieved this goal for despite the 2020 recession, the 2008 – 2009 recession, 2001 recession, the 1990 -1991 recession, the 1980 – 1982 recession, 1973 – 1975 recession, the 1970 recession, and the 1960, 1957, 1953, 1949, and 1945 recession, the devastation of the 1929 – 1938 recession-turned-depression has not re-occurred.

But, the U.S. Securities Exchange Commission has committed the crime of systematically excluding the masses of Americans from capital markets. Relative to access, the SEC has supported the growth of an oligopolistic economy which excludes entry by the poor and the middle class as purchasers of securities. Even more importantly, the SEC limits access to capital markets for all small-and-middle-size businesses.

Such behaviors by the SEC are, indeed, “Recidivist”, and, though legal, an absolute violation of the principles of democracy. As a result of such behavior, the United States, a country that was hailed as the leader of the free world, has now become labeled as a “… flawed democracy (Chandran, January 25, 2017).

Yes, I can hear your cerebral activity asking, “How does access to capital markets relate to the criteria used to rate a democracy? Several criteria serve as the measure of where the U.S. and/or other countries stand in terms of democracy. The criteria used includes: 1) the authenticity of the electoral process; 2) the level of participation of all persons in a pluralistic society; 3) the equitable distribution of civil liberties across all citizens in the pluralistic society; 4) the equitable distribution of civil liberties across all citizens in the pluralistic society; 5) the degree of inclusivity in the functioning and operations of all levels of government; 6) the maintenance of participating governments; and 7) a highly inclusive rather than exclusive political culture.” The SEC fails the democratic test. “How so?” you are now asking.

The answer is a simple one. The absence of access to capital markets in any country generates polarization and decreases the consensus that is so critical to a democracy. The systematic exclusion of females, minorities, middle and lower income groups, Democrats, rural residents, persons without advanced degrees, etc. has shifted America to a point in which 86% of Americans do not directly invest in the stock market!!!!!!!!

Approximately 38% of Americans participate in retirement programs such as 401(k) that do invest in capital markets. In contrast, 90% of persons in the United States whose income levels places them in the top 10% of the population as measured by income and wealth own stock. But, it is important to note that the SEC is the Gate-Keeper that recidivistically keeps capital markets closed to entrepreneurs who want to participate in capital markets by selling stock. The data supportive of such a serious charge is quite abundant. Table 1 below summarizes merely a sample of data that demonstrates the disparate impact of the SEC.

Approximately 2000 businesses in the United States went public so that they could access financial capital markets from 2013 – 2020. Only 18 or 9/10 of 1% of these were female-owned. Stated differently, more than 99% of the businesses were owned by males and not females. If the SEC seeks to promote democratic capital markets, why is its failure so dismal that a mere 2% of the billions of dollars available in capital markets are invested in firms that are owned by females?

Indeed, the SEC advertises its successes in excluding both females and minorities from capital markets. It recently reported to its target audience that well “…less than $70 trillion in global financial assets are managed by minority-owned or woman-owned firms (Bradford H., July 07, 2021) . While such data were released under the guise of the seeking of solutions to its exclusionary practices, it was also an inverted message to those Americans who are positively served by this federal entity exclusionary that it was successful in excluding unwanted populations from participation in capital markets!

In 1996, approximately 8090 companies in the USA were listed on a stock exchange. In 2019, this number dropped to 4266 companies. This represents a decrease of 47.27% (theglobaleconomy.com).

* However, in the over-the-counter market place, the number of companies grew to 11,500 between 2010 and 2021.

* But, the IPO process in general serves as an access route to capital markets only for large, predominantly non-new businesses that are also predominantly owned by very wealthy males of European-descent.

* Newer, smaller companies can gain access to capital markets versus the over-the-counter capital markets.

* The dominance of such a system of stratification is directly linked to SEC policies – policies that are designed to exclude rather than include.

As of February 28, 2020, only eight (8) publicity traded companies were owned by African-descended Americans:

1.) Urban One;

2.) Ping Identity Holding Corp;

3.) Global Blood Therapeutics;

4.) RLJ Lodging; 5.) Sycamore Entertainment Group;

6.) American Shared Hospital Services;

7.) Axsome Therapeutics.

8.) Urban Television Network Corp.

* As of 2016, an estimated 84% of all stocks were owned by the wealthiest top 10% of persons in the United States. This percent had grown from 71% in 2001 to 84% in 2016 – an increase of 18.3%.

* Other data could be cited.

However, the few items stated demonstrate that The Recidivist United States Securities and Exchange Commission controls capital markets. Its “Regulatory and Enforcement” power is such that it can exercise discretion in the applicability of its regulations. For example, on August 6, 2021 the SEC approved NASDAQ’s decision to mandate Board Diversity. But, had the SEC not been an agent for the rich and the non-diverse, the “Board Diversity” mandate would have originated with the SEC and been handed “off” to NASDAQ. Likewise, the SEC refused to mandate that publicly traded companies submit statistics on the employment of workers with one or more disabilities. The SEC did not track their own services to assess whether capital accessibility was improved among all Americans who have been historically excluded from the capital market.

I, Joseph Collins, and my team of loyal and committed staff have, over recent years, : 1.) taught previously excluded Americans regarding the importance of financial literacy and multiple income streams; 2.) Educated “capital markets disenfranchised Americans” regarding how to purchase stock by providing them access to $1 per share stock through our market offerings; 3.) Urged economically disenfranchised persons to apply a stair-step approach to starting and growing mini-businesses; and 4.) Have been publicly critical of the operations of capital markets and the systematic exclusion of numerous groups from these capital markets.

No! I have never committed a crime. However, even under the pretense of wanting to be more inclusive, SEC does not provide supportive services as a necessary accomplice to any programs that are allegedly designed to assist historically excluded groups in accessing capital markets. Despite the absence of services to support the deinstitutionalization of non-democratic capital markets by SEC, PUNCH has added the absolute largest Urban Stockable Base to capital markets in the history of the United States and you, the SEC simply do not like it. In order to terminate this effort, you have spent more dollars seeking to disrupt my efforts than you have on the real capital markets criminals! So, my message to you is, “Dear SEC: You think that by harassing and threatening me, Joseph Collins, I will cease and desist my efforts to include disenfranchised businesses in capital – generating markets? I will not do so for such exclusionary practices are hurting this country which I so dearly love! I will forever seek the inclusion of the poor and disenfranchised in the world of business ownership and in the world of financial capital accessibility since this is the primary and exclusionary roadblock to their economic growth!!”

But in doing so, I will continue to obey man’s laws and the laws of the universe. In this regard, I am a recidivist, should we revise the definition. As a part of that effort, I will continue to track the history of your “enforcement” efforts that disproportionately adversely impact women, minorities, the poor and the middle class! You may impugn my name, but you do not and cannot access my intellect! The more you misuse your powers in your entrapment efforts, the more evidence you will generate of your own dishonesty and anti-democratic, recidivist behavior!!!

You set a trap! You passed regulations that made it appear as if you were seeking inclusion when you are really seeking to expose and depose “Capital Market pioneers”.

The evidence of your absence of insincerity has been made explicit by the fact that even with a more inclusive opportunity, you failed to provide the infrastructure of services needed to support success! The Small Business Administration has already exhibited a template of the government-provided services needed to grow small, and/or minority and/or female businesses.

Admit it! You set us up to fail and to discourage other excluded businesses from even daring to attempt entry into capital markets!!!!

Bradford, H. (July 07, 2021). SEC Panel Approves Diversity and Inclusion Measures, Pensions and Investments.

Chandran, N. (Jan. 27, 2017). U.S. Is No Longer A Full Democracy, EIU Warns, CNBC, cnbc.com.

On September 30, 2021, the Securities Exchange Commission (SEC) filed an action against Punch TV Studios and its CEO Joseph Collins alleging that they raised more than $1.2 million from nearly 700 investors through unregistered offerings of Punch TV’s common stock.

The company and its CEO Joseph Collins believes that that SEC has it wrong and will seek to vigorously defend itself from such an aggressive action by the SEC.

The SEC’s complaint, which charges the defendants with violating the securities registration provisions of Section 5(a) and (c) of the Securities Act of 1933, seeks injunctive relief, disgorgement plus interest, civil penalties, and penny stock bars.

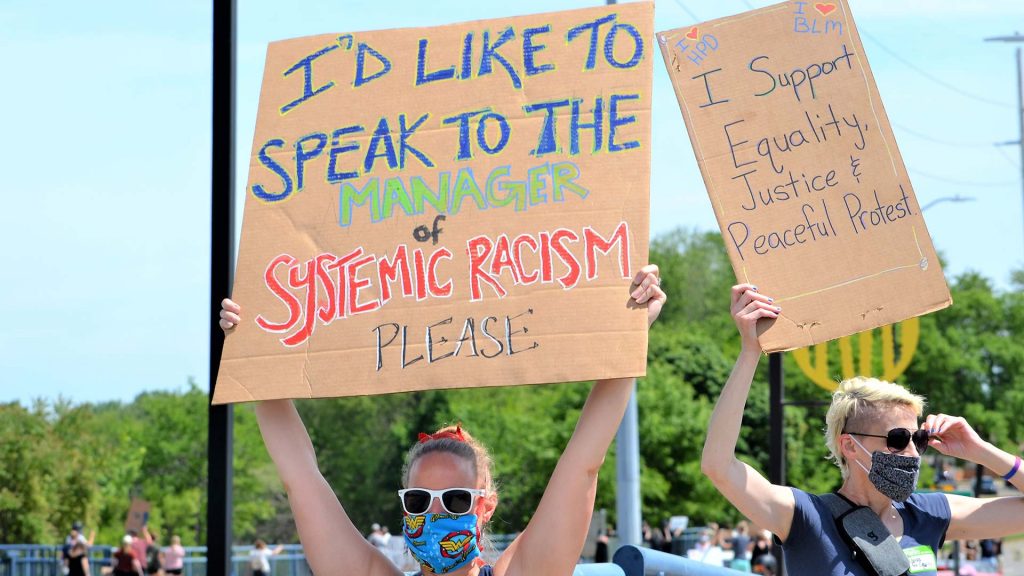

This is a terrible horrible mistake by the SEC, this critical decision will influence race and ethnic relations in the United States which have been amplified following the Black Lives Matter social movement. On the one hand, the President of the United States, Joe Biden, and the President’s Administration, have engaged in a public campaign announcing a “Plan to Rescue and Revitalize Main Street2 .” The Plan is designed to help black and minority-owned small businesses access capital. The Plan compliments the SEC’s mission to facilitate capital formation and assist small businesses access capital pursuant to the final rules in connection with amendments to Regulation A in 2015 (“Regulation A+3 ”).

However, Regulation A+ promoted an ideal that was not attainable by black entrepreneurs like Mr. Collins. The SEC must decide whether it intends on supporting the President’s Plan by deciding not to bring an enforcement action in this case. The wrong decision will have unforeseeable and unintended ramifications such as chilling African American participation in capital markets and further fueling the distrust of government felt by the majority of minorities. During President Joe Biden’s speech on June 1, 2021 in Tulsa, Oklahoma, he told a crowd that black entrepreneurs are as successful and capable as white entrepreneurs but need more resources. In addition, President Biden stated that small businesses are the engines of the U.S. economy and the glue of U.S. communities. Moreover, African Americans don’t have access to lawyers and accountants like whites. In this case, Mr. Collins and the Company relied on experts for financial and legal advice. Since the SEC chose to bring this case, it will send a message to African Americans that they cannot do right before the eyes of the law or the courts in the United States if they decide to raise capital by relying on federal regulations, even if they hire accountants and specialized lawyers to help them navigate a system that has long excluded their participation. SEC is clearing sending a message that having even if you relied on the advisement of creditable counsel, entrepreneurs, who are not attorneys may still be persecuted by laws that were not designed for African American nor people of color. Even if the government designs a program that is supposed to inspire capital growth in the community.

As the CEO, I say shame on the SEC.

Punch TV Studios has provided more the 150 jobs for at risk youth and more than 110 good paying jobs to people of the community through its life-time. As the CEO Mr. Collins has forgone his salary until the company becomes profitable.

President Biden asked the audience to imagine, instead of denying millions of entrepreneurs the ability to access capital and contracting, what if it was made possible to take their dreams to the marketplace to create jobs and invest our communities. The data shows young black entrepreneurs are just as capable of succeeding given the chance as white entrepreneurs are, but they don’t have lawyers, they don’t have accountants, but they have great ideas. The Administration set up the national small business administration so that minorities can have more access to capital. If African Americans are to be as capable as white entrepreneurs as stated by President Biden, then they must be given the infrastructure to succeed and the understanding that if they fall in their beginning attempts, they must get back up and attempt to succeed, even in an economy that has historically been designed to exclude them. We ask you to imagine, instead of punishing Mr. Collins for being the first African American who raised capital under Regulation A for the Company, what if the SEC engaged in discussions with Mr. Collins and the Company to determine how to develop new programs by the SEC’s Office of Investor Advocacy and Education to encourage and support African American participation in capital markets. Regulation A+ was more attractive than Regulation A for several reasons.

The JOBS Act established a regulatory structure for startups and small businesses to raise capital through securities offerings using the Internet through crowdfunding. The crowdfunding provisions of the JOBS Act were intended to help provide startups and small businesses with capital by making relatively low dollar offerings of securities, featuring relatively low dollar investments by the “crowd,” less costly. The SEC believed that the overall intent of providing the exemption under Section 4(a)(6) was to provide an additional mechanism for capital raising for startup and small businesses and not to affect the amount an issuer could raise outside of that exemption. The startups and small businesses that the SEC expect[ed] would rely on the crowdfunding exemption were likely to experience a higher failure rate than more seasoned companies.

Now the SEC wants to punish our company, for what it alleges and has termed a “Technical Error”. There is clearly no fraud, nor criminal activity, but a Technical Error. As the CEO, I asked the question where’s the support system for people of color that want to use a Regulation A, which was purported by the government to give access to capital markets without the need for investment bankers.

Punch TV Studios has more than 11,000 stockholders that are directly from the urban community, 99.5% of whom are in full support of the direction of the company and support its CEO Joseph Collins. We are believed to have the largest base of independent investors in America.

The SEC’s “regulation by enforcement” approach has had a negative impact on African Americans in general. While there are presently no statistics available to cite, the overwhelming majority of public companies or their officers and directors are not African American. This enforcement action against the Company and Mr. Collins would confirm for African Americans that they have no place in the capital markets of the United States.

SEC Chair Mary Jo White’s October 28, 2015 keynote address to Practicing Law Institute’s 47th Annual Securities Regulation Institute, just under six months before the Company’s Regulation A Offering was qualified by the Commission, indicated that it was too early to draw conclusions on Regulation A+ and stated: “Companies are beginning to take advantage of the new rules in greater numbers than was the case under the prior version of the exemption, with approximately 34 companies publicly filing offering statements and 16 companies filing non-public draft offering statements. The staff has qualified three offerings so far, and it remains to be seen how investors will react to such offerings. The Company was one of the first Regulation A offerings to be qualified by the Commission on April 5, 2016, and it was historic because it was also the first African American-owned company to be qualified by the Commission.

We believe that the SEC’s case will fail because there was no “sale” of securities for purposes of Section 5 of the Securities Act because sales were made prior to the beginning of the Suspension Period. We further contend that the suspension-period, which was for only 9 months, was in and of itself an over-reach by the SEC. The company settled for the suspension-period in hopes of resolving this issue. The transactions that are the subject of this lawsuit were initiated to collect payment from shareholders who were issued shares but did not pay the Company for those shares. In-house counsel who specializes in securities law during the Suspension period (hired about April 2018) as communicated by Mr. Collins in SEC testimony, “this is not a sales process; this is a collection process. And so it’s not about selling shares. It’s about collecting the money.”

There is no government infrastructure to assist disadvantage population and communities of color in investment banking, trading securities, or implementing Regulation A+. The goal of Regulation A was to put money in the hands of small businesses without the need for investment bankers who end up profiting from the transactions. Barriers for African Americans that prevent access or even to gain a footing in the U.S. financial markets is historic, current, and systemic.

At the time Punch TV commenced its Regulation A Offering, there were no Public Company Accounting Oversight Board qualified CPAs that would work with African Americans. Access to qualified attorneys was also limited because there were few attorneys who had experience with or really understood Regulation A+ because it was so new, let alone attorneys willing to assist African Americans entrepreneurs. The system created by the U.S. Government and the SEC discriminates against entrepreneurs of color who engage in capital raising activities without investment bankers because it fails to provide professional resources that are readily available to privileged members of society.

Yet, despite the fact that African Americans do not have the same resources, the SEC is proposing enforcement to hold accountable entrepreneurs of color to the same standards as privileged members of society. In this case, Mr. Collins made every attempt to procure professional or specialized resources that are not readily available in the African American Community. For example, Mr. Collins searched nationwide simply to find a CPA that would work with the Company because of the hesitancy and wariness of professionals willing to work with African Americans in capital markets.

Mr. Collins was finally only able to locate someone that pretended to be a CPA. But the company discovered that he lied lied about his qualifications as a CPA. The Company’s attorney at the time advised the Company to disclose that there was an administrative error in connection with the Company’s financial statements instead of saying explicitly that the CPA lied about his qualifications. The CPA’s lie and the attorney’s bad advice on how to disclose the lie resulted in the SEC suspension. Punch TV, however, is paying the price for bad advice from experts, hired in good faith, retained in a system that does not provide adequate understanding or support to the unique challenges faced by African Americans. The company was able to find Ira Viener CPA to complete the audit of the company. The SEC infrastructure has not been designed with the intent to include African Americans and allows only privileged people to thrive. The limited successes attained by people of color are a rare exception in capital markets.

Mr. Collins relied on the way that Regulation A+ was marketed by the SEC, trusted that the government created Regulation A to help small businesses fund themselves to get off the ground, and acted according to the spirit of the law. Mr. Collins certainly did not foresee at that time that an SEC investigation would unfold in the manner it has to date over a program that was purportedly designed to help small businesses. (Joseph Collins SEC Investigative Testimony, June 17, 2021, Page 1023 at Lines 4-25). Mr. Collins did not foresee that the SEC would not be helpful in providing solutions, but instead, would cause Company employees including himself, to testify often eight hours per day, day after day, in connection with such an investigation. We find this to be egregiously bias and unwarranted.

Each of the individuals who testified, when advised that they could have representation, asked for representation to be paid for by the SEC because none of the individuals who testified could afford representation. The SEC said that they were simply being asked a few questions and the SEC literally had community people giving testimony without the benefit of an attorney. They were advised they had the right to an attorney, but obviously the witnesses could not afford an attorney. So, they testified without the benefit of an attorney to help you understand the questions they were being asked.

So let me paint this picture, you as a member of the community are in a room full of attorneys, questioning you about the company, but you have no attorney on your side to help you understand the questions.

The foregoing not only highlights the lack of support or infrastructure required by African Americans to succeed in capital markets, but the harsh reality that in the U.S., you only get as much justice as you can afford.

Regulation A was new at the time and should have provided allowances and support for infrastructure and accessible resources for entrepreneurs to succeed since the goal of Regulation A is to create jobs, wealth or empower small businesses or people of color. Since the Company was forced to develop its own platform, it experienced system glitches without a team of IT technicians to immediately identify and resolve any issues.

Given that a SEC Commissioner publicly states the SEC needs support drivers of economic growth and not hinder growth of minority-owned businesses, how will enforcing this action against Mr. Collins accomplish this goal? This action will only exacerbate the problem that the SEC is claiming to address. If the SEC really wants to take an active role in empowering minority-owned businesses and assisting them in obtaining capital so they may grow, the SEC will help Mr. Collins by providing an opportunity for him grow his business, that may be shut down by the proposed enforcement action. Mr. Collins has already been punished for being an African American. The SEC should be the instrument for his success by providing resources Mr. Collins needs to succeed rather than causing the failure of a minority owned business with a minority stockholder based .

The Company and Mr. Collins acted in good faith when they hired and relied on in-house counsel with specialized securities law knowledge to navigate the Company through the complicated securities framework. To say that Mr. Collins could have done anything more would imply that he would have needed to be another person, perhaps a privileged securities attorney of another race, which is a factual impossibility. Companies engaging in Regulation A are not provided with a set of specific procedures for ensuring that they do not violate federal securities laws.

The SEC investigative process in and of itself has been an expensive and laborious burden to our small company, which we believe is intentional. We have had to dedicate tremendous resources to comply with the demands of this investigation. All of this for Regulation A, a regulation that was supposed to be designed to empower job growth and entrepreneurship, has become analogous to a “high-tech lynching” of Punch TV Studios, its CEO and potentially, every African American that attempts the same.

Here is the audio replay of the Conference that was held on Saturday July 17, 2020. (To listen press the play button above) "We will respond to you via email

We are setting the new direction for Punch TV Studios. There has never been a more compelling time to be a global leader in media. It is fundamental to use our economic force to access and participate in shaping our world

Together we can change the world.

You may email your questions in advance to ir@punchtvstudios.com

Call in to speak with the host (516) 666-9817

Submit your questions early so that they will be in the que.